We need to be raising awareness on just how bad of a shape Thorchain lending is right now, posing a potential risk to the protocol itself. As it stands, at current mark to market rates for RUNE, complete loan closure will mint 24 million RUNE. 1,604 in BTC collateral, 18,258

What's going on with Thorchain (RUNE)?

January 10, 2025

In this post

A combination of falling RUNE prices and inflationary mechanisms have led to systemic risks for Thorchain. Here's a look back at recent events, community and team reactions, and the outlook for the months ahead.

Context and Key Information

Thorchain is a cross-chain decentralized finance protocol that has set itself apart with a unique value proposition: enabling direct native asset swaps between blockchains without relying on centralized solutions or wrapped tokens. This technology uses its native token, RUNE, to ensure liquidity across various blockchains and facilitate transactions.

Over the past few hours, certain members of the Thorchain community have raised alarms about key protocol mechanisms-which we will detail later-that have exacerbated an inflationary dynamic for RUNE. This inflation is placing downward pressure on the token, which in turn exacerbates the inflation, creating a negative spiral.

Although these risks have been long understood, discussions around them have intensified in recent days. Thorchain's team, led by founder JP Thorbjornsen, responded quickly by suspending certain functionalities to gather community feedback and assess the best course of action.

In this investigation, we analyze the mechanisms identified by the community, their impact on RUNE’s inflation, the recent exchanges between Thorchain's team and its users, and the outlook for the coming months.

Thorchain Mechanisms

Lending

Thorchain's Lending program is one of a kind. It operates without fees, liquidations, or expirations, provided the collateral is maintained at a 200% ratio. Users can deposit native assets like BTC or ETH as collateral to borrow a dollar-pegged asset, TOR.

When a loan is initiated, the collateral deposited by the user is converted into RUNE through liquidity pools and then burned. This process temporarily reduces the total supply of RUNE, creating a deflationary effect. Conversely, when the loan is repaid, RUNE tokens are minted to repurchase the native asset, increasing the circulating supply.

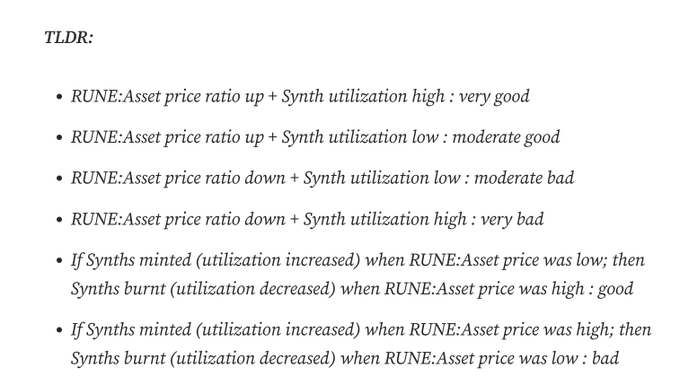

In theory, this mechanism is neutral if the price of RUNE remains stable. It can even become deflationary if RUNE appreciates relative to the collateral deposited. However, in a bear market, significant issues arise:

- If RUNE’s price drops relative to the collateral, Thorchain must mint more tokens to cover the value of the collaterals.

- This structural inflation increases downward pressure on RUNE’s price, creating a self-reinforcing dynamic where each drop worsens the situation.

To mitigate risks, safeguards were implemented, including a strict cap of 5 million RUNE that can be minted to cover loans. If this limit is reached, the reserve would intervene to repurchase the loans. However, these measures have not alleviated concerns, and in September 2024, Thorchain suspended new deposits into the Lending program.

Synthetic Assets

Synthetic assets on Thorchain are digital representations of native assets, created from the liquidity of pools. Each synthetic asset is backed 100% by collateral consisting of equal parts native assets and RUNE.

When a user creates a synthetic asset, half of their deposit is automatically sold to buy RUNE, which is used to build the collateral. This process directly links the value of RUNE to that of synthetic assets.

If RUNE’s price remains stable, this mechanism works efficiently as new deposits balance out redemptions. However, if RUNE loses value relative to the native asset, the protocol is forced to sell more RUNE to enable users to redeem their native assets.

Savers Vaults

Introduced through ThorFi, the Savers program offers users a way to earn yield on their native assets without exposing them to the risks associated with bilateral liquidity pools, such as impermanent loss.

When a user deposits a native asset into a Savings Vault, the asset is used to create a synthetic asset, which is then integrated into liquidity pools. The rewards from swap fees are redistributed as yield. In return, the user receives Saver Units, representing their share in the Vault, which can be redeemed at any time for the initial native asset and any generated yield.

Again, as this model depends on the functionality of synthetic assets, it can become problematic if RUNE depreciates relative to the native asset. Massive withdrawals force the protocol to sell synthetic assets to repurchase native assets, exacerbating sell pressure on RUNE, especially if it is already in decline.

A Negative Spiral for RUNE

This section was written with the help of @ate_bites on X, whose contribution is gratefully acknowledged.

The interdependence of Thorchain’s three key mechanisms-Lending, synthetic assets, and Savers Vaults-has created a dynamic where each component amplifies the vulnerabilities of the others. At the root of this problem lies an implicit assumption: RUNE’s price, as the backbone of the entire system, must remain stable or even appreciate relative to native assets like BTC or ETH.

However, over the past two years, RUNE has lost about 38% of its value against Bitcoin. This prolonged decline has highlighted structural flaws in Thorchain’s mechanisms:

- Excessive Minting of RUNE and Structural Inflation

When RUNE’s price falls, the protocol must mint more tokens to cover Lending debts or facilitate synthetic asset redemptions. This minting increases the circulating supply, dilutes the token’s value, and reinforces inflationary pressure.

Combined with massive withdrawals from Savers Vaults, this creates a self-reinforcing dynamic. The required RUNE sales to balance pools or reimburse users amplify the downward price pressure, worsening the token’s decline.

- Under-collateralization of Pools

The decline in RUNE’s value relative to native assets reduces the liquidity pools' ability to back synthetic assets. When users attempt to redeem their native assets, the protocol must sell more RUNE to complete the transactions, further weakening the pools.

In a context of widespread withdrawals, this dynamic can quickly erode confidence in the protocol’s solvency, exacerbating market tensions.

- A Spiral Similar to Terra (LUNA)?

In the community’s perception, this situation has drawn parallels to the collapse of Terra’s ecosystem and LUNA in 2022. While the mechanisms differ-Terra relied on an algorithmic stablecoin-the two cases share a critical characteristic: over-reliance on a native token to absorb economic fluctuations and ensure system stability.

At Thorchain, RUNE’s role in Lending, synthetic assets, and Savers makes it a central pivot. When it loses value, it triggers a chain reaction that weakens the entire protocol. In other words, it creates a negative spiral where RUNE sales and minting directly impact the token’s market price, triggering a decline that further amplifies the inflationary effects of these mechanisms, and so on.

It is important to note, however, that there is a real difference between what happened with Terra in 2022 and Thorchain’s current situation. The aforementioned issues have been known for a long time, and precautions were taken by the team to prevent such scenarios (minting caps, reliance on 50% synthetic assets, etc.).

Recent Developments

The issues discussed in the previous sections are not new: they have been the subject of community articles and are explicitly mentioned by the Thorchain team in their documentation.

Community Mobilization

In recent days, numerous voices within the community have raised concerns about Thorchain’s mechanisms and their adverse effects on RUNE’s price. These members called on the team to act swiftly to prevent the situation from deteriorating further.

Loading tweet...

This user, particularly active within the Thorchain community, explained that if RUNE’s price continues to fall, it could trigger panic among users seeking to close their Lending positions. According to him, the impermanent loss embedded in these positions represents approximately 24 million RUNE to be minted-equivalent to 7% of the current circulating supply-which could further worsen RUNE’s price action.

In response to these concerns, some community members have advocated for drastic measures, such as shutting down the programs immediately

Loading tweet...

Or forcibly liquidating all active Lending positions to mitigate the risk of this negative spiral and stabilize RUNE:

Loading tweet...

“If BTC falls to $75-85k, RUNE will likely drop below $3. The best move is to take advantage of this market downturn to get rid of something harmful (Lending). […] The best time to force loan closures was above $6, but the second-best time might be now.” - @ThorTrades8 on X

Indeed, if we examine this Nine Realms dashboard, it shows that an immediate closure of all Lending positions would result in a difference of 22.7 million RUNE (approximately $80 million) between the amount burned at entry and minted at exit, equating to a 445% ratio.

Thorchain Team’s Response

One of Thorchain’s strengths lies in the active communication of its founder, JP Thorbjornsen, with the community. Highly active on social media, he quickly responded to concerns by inviting everyone to join discussions on the Thorchain developers’ Discord.

Simultaneously, the team issued a statement announcing the immediate suspension of the Lending and Savers programs for a duration of 12 months. This decision was made by a “mimir” administrator following consultation with developers, node operators, and key community members.

However, this unilateral decision sparked criticism. The community demanded a more transparent process, leading to a decentralized vote among node operators. Following the vote, the Lending and Savers functionalities were temporarily reinstated, and a 72-hour discussion window was opened to allow the community to propose solutions.

Meanwhile, data from Nine Realms shows a notable shift in user positions. The amount of Bitcoin used as collateral dropped from 1,598 BTC on January 9th at 1:00 PM to 1,365 BTC on January 10th at 1:00 PM, indicating a massive user disengagement amid uncertainty.

Current Proposals

As of the time of writing, here are the proposals being discussed:

- Ending Admin Mimir Activities: The administrator responsible for suspending Lending and Savers functionalities will be relieved of their role.

- Timeout for Savers: Savers functionalities will be suspended for six months, allowing developers to focus on strategic priorities.

- Tokenization of Existing Positions: After the six-month timeout, Lending and Savers positions will be transformed into tokenized assets, enabling holders to trade them on peer-to-peer markets.

- Introduction of a Protocol Income Tax: A "System Income Tax" could be implemented to gradually repay liabilities.

- Migration to an App Layer: Complex ThorFi functionalities, such as Lending and Savers, will be isolated into a distinct application layer, reducing the complexity of the base layer.

Perspectives and Criticisms

While the timeout provides an opportunity to reassess fundamentals, Thorchain’s success will depend on the team’s ability to execute this plan rigorously. The migration to an App Layer is seen as a way to simplify the ecosystem, but it will not address the short-term structural issues related to liabilities and RUNE inflation.

Discussions within the community are ongoing. Some propose capping the amount of RUNE that can be minted daily during loan closures, creating a withdrawal queue that is easier to predict and manage.

Others argue for shifting the extra minting burden-the difference between the RUNE burned at loan opening and minted at closure-onto the position holder by imposing a form of slippage.

Loading tweet...

Essentially, this means reintroducing fees on Lending activities (which currently have none), a proposal gaining traction.

Finally, as Thorchain is one of the highest revenue-generating protocols-distributing approximately $50 million annually to nodes and liquidity pools-some community members advocate redirecting a portion of these fees to offset liabilities and RUNE inflation.

As evident, Thorchain stands at a crossroads. The combination of RUNE’s underperformance against other assets, inflationary mechanisms, and the growing latent mintable RUNE (via impermanent loss or synthetic assets) has made it clear that decisive actions are necessary.

Editor’s Note: One of the most negative aspects of the protocol is its reliance on the price of the RUNE token. The protocol’s operation was built around a bet on RUNE’s performance compared to other assets like BTC or ETH. Currently, it’s precisely this bet that is causing controversy within the community and drawing the protocol closer to the model of LUNA mentioned above. The situation should be closely monitored, and we will keep you updated on upcoming developments via our Twitter.

Update 01/24/2025: Is Thorchain Insolvent?

Recent developments have confirmed the severity of the situation for Thorchain, with major decisions made by the community and node operators. Here are the latest events and their implications for the protocol:

Drop in RUNE/BTC Price

As of January 22 (before the events detailed below), RUNE's price had dropped by 20% against BTC since the publication of our earlier analysis. This decline reinforces previously raised concerns, particularly the risk of a downward spiral exacerbated by the ongoing devaluation of RUNE relative to major assets like BTC and ETH.

Note: As a reminder, the Lending and Savers programs rely on a key assumption: the outperformance of RUNE relative to BTC and ETH.

Massive Lending Withdrawal

Yesterday, a user initiated a sudden withdrawal of 3,500 ETH from the Lending program, triggering the following chain of events:

- A request to withdraw 3,500 ETH (approximately $11 million) from Lending collateral;

- The protocol minted approximately 3.8 million RUNE to cover the repayment;

- The minted RUNE was sold on the market to purchase ETH and repay the user.

This single withdrawal effectively nullified all RUNE previously burned during the opening of Lending positions by users. Now, each closed position will exponentially increase the RUNE supply, further intensifying the downward pressure on its price.

Thorchain’s Insolvency Situation

According to the latest estimates, Thorchain is facing massive liabilities:

- $73 million in debts tied to the Lending program (primarily in BTC and ETH);

- $98 million in obligations from the Savers program and synthetic assets.

These liabilities, totaling over $170 million, far exceed the liquid assets available in liquidity pools, estimated at less than $100 million. Any attempt to repay these debts would only exacerbate the inflationary spiral, reminiscent of the Terra (LUNA) collapse.

Permanent Suspension of Lending and Savers Programs

The Lending and Savers programs, already frozen for deposits over the past year, have now been fully suspended. Node operators have voted to freeze all existing positions, temporarily making debts and collateral inaccessible. This freeze aims to prevent the crisis from worsening and provide time to develop a restructuring plan.

Note: Contrary to some rumors, Thorchain continues to produce blocks, and its cross-chain swap functionality (the protocol's core feature) remains fully operational.

Restructuring Plan Proposals

The Thorchain community is actively exploring solutions to stabilize the protocol and preserve its remaining value. Proposed options include:

- Debt Tokenization: Lending and Savers positions would be frozen and converted into tokens, tradable on a secondary market.

- Creation of an "Unwind Module": This module, funded by 10% of protocol revenue, would allow claim holders to sell their positions based on available liquidity.

- Priority for Liquidity Providers: Liquidity pools and arbitrageurs would continue to operate, ensuring the continuity of swaps on the DEX.

Note: These measures aim to restore confidence and enable the protocol to rebuild on more solid foundations while protecting remaining users. However, no final decisions have been made yet.