Layer 1: Activity report August 2024 (Ethereum, Tron, Solana, BNB Chain)

September 24, 2024

In this post

In a difficult summer period for financial markets, and a historically quiet one for cryptocurrencies, user activity on layer 1 blockchains fell sharply in August 2024. In this report, we detail the metrics of the main layer 1 blockchains to provide a clear and actionable picture of the evolution of this sector.

Key Information

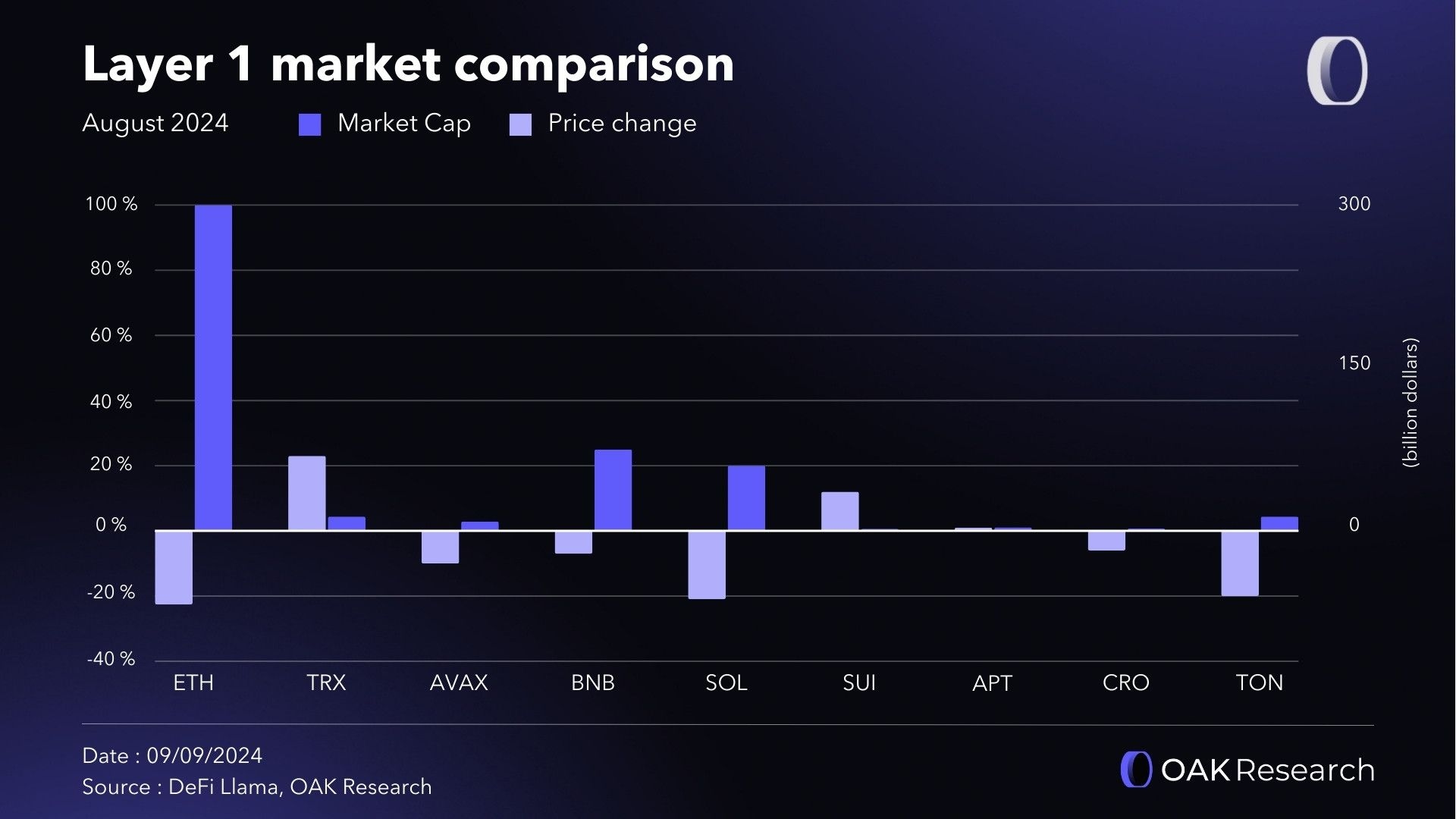

- Despite a general decline in the cryptocurrency market, some Layer 1 cryptocurrencies like Tron (TRX) and Sui (SUI) experienced positive performances, with respective increases of 23% and 12.6%.

- Most Layer 1 blockchains - including Ethereum, Solana, and TON - saw a decline in their TVL, except for Tron and Sui, which continued to grow.

- Solana and Avalanche compensated for the loss in token value (in dollars) through capital inflows, increasing their TVL by 2% and 3.8%, despite significant price drops.

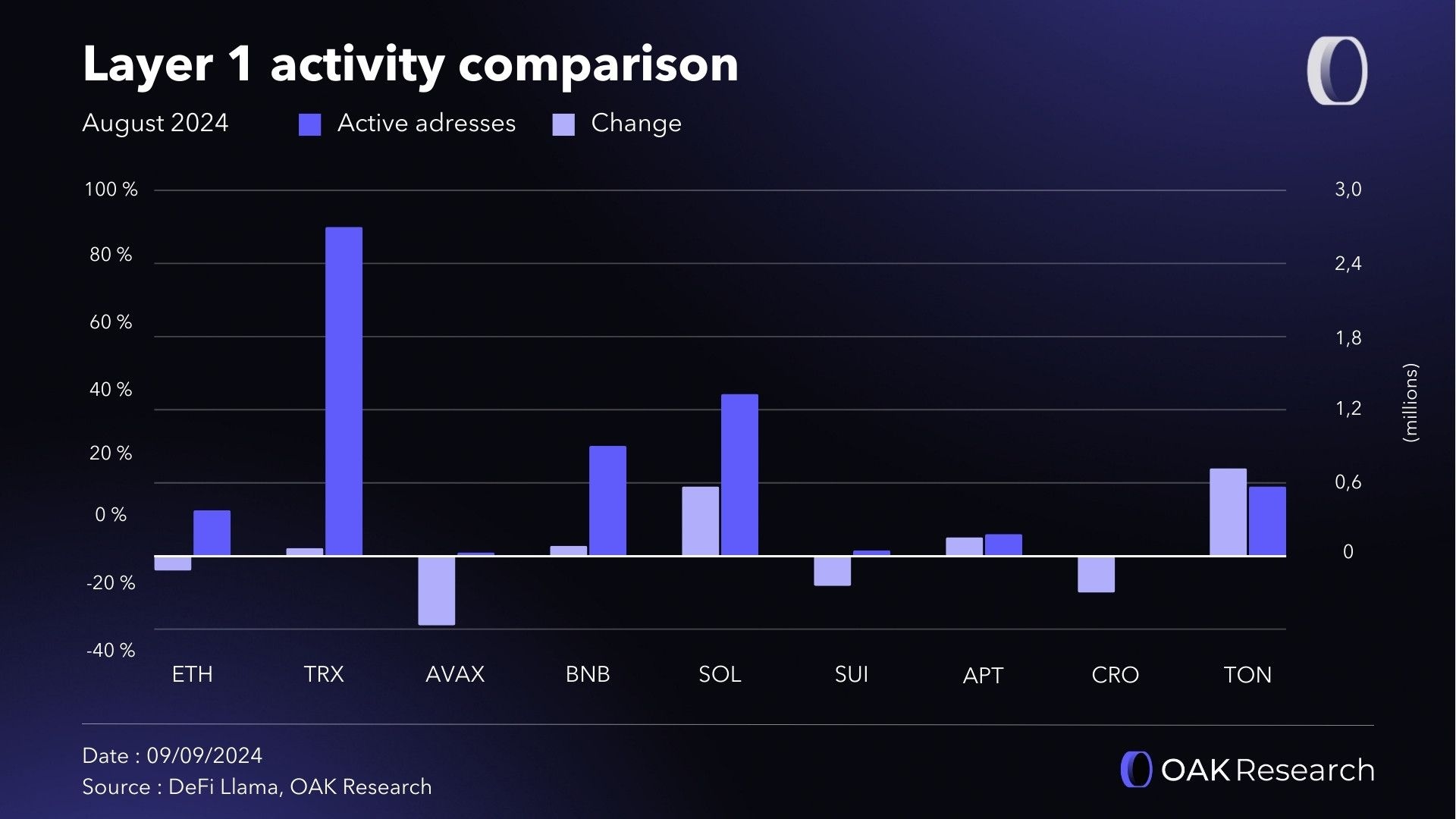

- The number of daily active addresses on blockchains such as Solana (+19%) and TON (+24%) increased, while Ethereum recorded a decline for the fifth consecutive month (-4%).

- Hyperliquid continues to grow organically and steadily, now ranking 5th among blockchains in terms of TVL, closing in on Avalanche.

Financial Analysis of the Layer 1 Sector

August was a relatively difficult month for the cryptocurrency market, with a roughly 8.75% drop in the price of Bitcoin (BTC). Most Layer 1 blockchain tokens also recorded significant declines, although a small minority managed to maintain positive performances.

Layer 1 Cryptocurrencies Down in August 2024:

- Ethereum (ETH): -22.6%

- BNB Chain (BNB): -7.6%

- Solana (SOL): -21.2%

- Avalanche (AVAX): -11.2%

- Cronos (CRO): -6%

- The Open Network (TON): -19.7%

Layer 1 Cryptocurrencies Up in August 2024:

- Tron (TRX): +23%

- Sui (SUI): +12.6%

- Aptos (APT): +1.1%

Overview of Layer 1 Cryptos

Among the biggest declines, Ether (ETH) stands out with a 22.6% drop in one month, resulting in nearly $80 billion being wiped off the market capitalization of the second-largest cryptocurrency. This drop is the most significant among Layer 1 blockchain tokens.

Other notable declines include Solana (SOL) and The Open Network (TON), with respective drops of 21.2% and 19.7%. It’s important to note that Toncoin (TON) was particularly affected by the news of the arrest of Pavel Durov, Telegram's CEO, on August 24th. Although TON is no longer officially linked to Telegram, the two ecosystems remain closely connected, heightening investor uncertainties.

On the other hand, two remarkable performances were observed in August: Tron (TRX) and Sui (SUI), which rose by 23% and 12.6%, respectively. Tron's increase may be attributed to the recent surge in network activity, due to the launch of SunPump, a memecoin creation platform inspired by Solana’s Pump Fun. Enthusiastically promoted by Justin Sun, Tron’s founder, this platform attracted new users and boosted demand for TRX.

As for Sui, several factors may explain its strong performance. At the end of July, the network benefited from a major update (Mysticeti), which significantly improved its performance while reducing transaction fees. Additionally, Mysten Labs (the entity behind Sui) announced its support for developing a Web3 gaming industry on the Sui blockchain, as well as the launch of a handheld console to play cryptocurrency-based video games.

Fundamental Analysis of Layer 1 Activity

As expected, the total value locked (TVL) in decentralized finance (DeFi) protocols on various Layer 1 blockchains generally declined during August 2024.

Layer 1 TVL Decreases in August 2024:

- Ethereum (ETH): -14%

- Tron (TRX): -0.6%

- BNB Chain (BNB): -7.1%

- Avalanche (AVAX): -11.2%

- Cronos (CRO): -8.9%

- The Open Network (TON): -26.8%

Layer 1 TVL Increases in August 2024:

- Solana (SOL): +2%

- Avalanche (AVAX): +3.8%

- Hyperliquid (no token): +13%

- Sui (SUI): +5.5%

- Aptos (APT): +5.9%

Overview of Layer 1 TVLs

Ethereum’s TVL decreased by 14%, dropping from $57.6 billion to $49.5 billion on average. However, with ETH prices down 22.6% over the same period, this suggests that the total amount of ETH locked in DeFi actually increased, indicating a resurgence of activity despite falling prices.

The situation is even more interesting for Solana and Avalanche, whose TVLs increased by 2% and 3.8% respectively in August, despite their token values dropping by 21% and 11%. In other words, new user deposits on these blockchains compensated for the loss in token value on the market.

In contrast, despite TRX’s remarkable market performance (+23%), Tron’s network TVL fell by 0.65% in August. The total amount of assets locked in DeFi decreased from 63 billion to less than 50 billion TRX, a drop of about 20%. While the memecoin trend on SunPump positively impacted TRX prices, it had no noticeable effect on Tron’s TVL, revealing a divergence between investors’ positive sentiment-bolstered by Justin Sun’s support-and the on-chain interest, which remains relatively low.

Finally, the Hyperliquid network continues to show organic and sustained growth, with a 13% increase in TVL on its decentralized trading protocol, operating on its own blockchain. With the end of the second season of its point distribution campaign in preparation for an airdrop set for September, it will be interesting to follow the evolution of Hyperliquid's TVL in the coming months.

Comparison and Trends for Late 2024

First, let’s examine the TVLs of the top Layer 1 blockchains, excluding Ethereum: Tron, BNB Chain, and Solana. The trend observed in recent months was confirmed once again in August; Solana continues to grow significantly and maintains the lead it gained over BNB Chain last June.

In contrast, Tron’s TVL has remained stable, equivalent to its level at the beginning of 2024, meaning its second place is increasingly under threat from Solana.

Meanwhile, another competition is unfolding among the blockchains ranked 4th to 9th, including Avalanche, Hyperliquid, Sui, Aptos, Cronos, and TON. It is noteworthy that Avalanche retains its leadership position despite its TVL stagnating since the start of the year, while the other blockchains have made significant gains.

With the exception of Cronos, whose TVL has remained stable, all Layer 1 networks have shown growth in 2024. The duel between Aptos and Sui has taken an interesting turn in August. After a strong start to the year for Sui, it saw a significant TVL drop at the end of July. However, the announcements mentioned earlier in this article helped it regain an advantage over Aptos.

Lastly, Hyperliquid’s steady, linear growth also stands out, as the network now ranks 5th among blockchains by TVL, rapidly closing in on Avalanche.

Study of On-Chain Activity: Active Addresses

Despite a significant TVL decline in August, TON recorded a more than 24% increase in the average number of daily active addresses, reaching 549,000. Solana, meanwhile, posted positive growth for the third consecutive month (+19%), with 1.28 million daily active addresses. In contrast, Ethereum's daily active address count fell for the fifth consecutive month (-4%).

For Sui, this metric’s analysis confirms the sentiment mentioned earlier: the apparent increase in TVL (in dollars) actually masks a liquidity outflow from the network (in terms of SUI). In August, the number of active addresses fell by 8%, stabilizing at 45,000.

Finally, it’s worth noting that daily active addresses on Tron increased by only 2.1% in August, despite a rise in trading volumes on the network due to memecoin trading. Some attribute this to Tron already having a solid user base, while others believe memecoin volumes are artificially inflated to attract new

Conclusion

August 2024 was a relatively bearish month for the cryptocurrency market, marked by contrasting trends within the Layer 1 blockchain ecosystem. While the majority of networks saw the value of their native cryptocurrencies decline, some managed to maintain or even increase their TVL (Solana, Sui and Tron).

Others, such as Hyperliquid, continue to post steady growth since the start of 2024. Although the decentralized trading app is proving a real success, it remains difficult to assess its real adoption until the airdrop points distribution campaign is complete. This will be a key point to watch for in the next report in September, when this campaign comes to an end.

These variations indicate that, despite relatively complicated market conditions this summer, opportunities have arisen for some Layer 1 blockchains to take advantage of them. Over the long term, the trend remains the same, with linear growth for some networks (Solana, Sui, Aptos) while others are stagnating (Tron, BNB Chain, Cronos).