LayerZero (ZRO) acquires Stargate (STG) for $110 million: Background, analysis, and outlook

August 27, 2025

In this post

The Stargate DAO has recently approved the acquisition of the protocol by LayerZero for 110 million dollars. Despite a majority “yes” vote, the deal has raised many concerns about the speed of the process, the strong criticism voiced by DAO members, and the competing 120 million dollar bid from Wormhole, Stargate’s main competitor. Let’s review how events unfolded.

Background on Stargate

Stargate Finance is a bridge developed by LayerZero Labs and launched in March 2022. Its goal is to facilitate liquidity transfers across blockchains without relying on wrapped asset versions, as most bridges do today. Stargate promotes an interoperability model designed to be more efficient and secure thanks to LayerZero’s infrastructure and the OFT (Omnichain Fungible Tokens) standard.

OFTs allow the same token to exist natively on multiple blockchains, without needing different “wrapped assets” for each chain. When a user transfers a token via Stargate, it is recognized on the destination chain as the same asset rather than a copy. This model simplifies liquidity management, reduces risks tied to traditional bridges, and offers a better foundation for multichain DeFi protocols.

Although Stargate was developed by the same team as LayerZero and they continued collaborating, the bridge became independent with the launch of its STG token and the creation of the Stargate DAO. In total, 17.5% of STG was reserved for the team and may therefore still be in LayerZero’s hands.

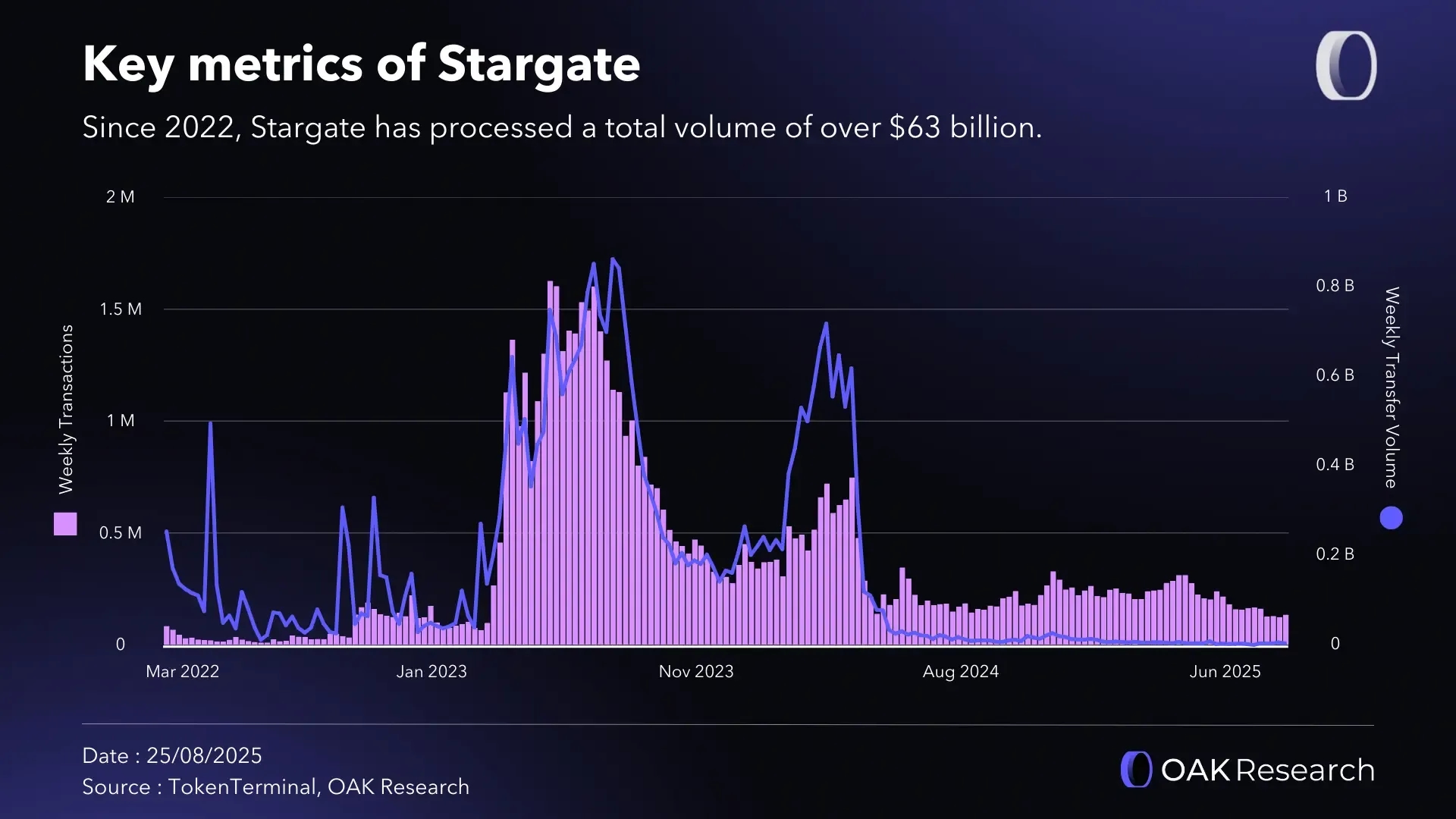

Today, Stargate is implemented on more than 80 blockchains, mostly EVM-compatible, but also some outside that ecosystem such as Solana, TON, and Aptos. Since its 2022 launch, Stargate has processed more than 50 million transactions for a total volume exceeding 63 billion dollars.

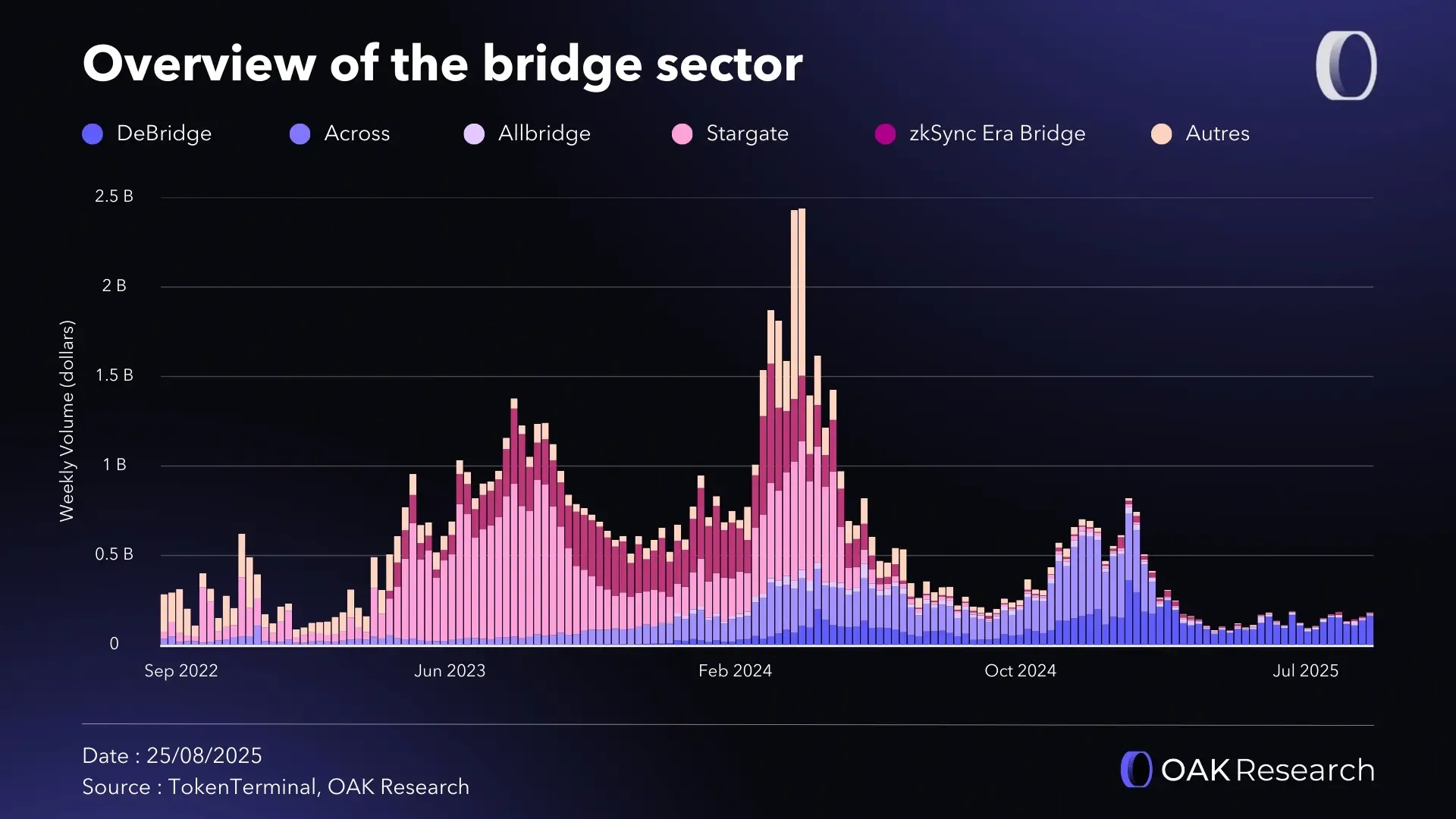

According to DefiLlama, for 2025 Stargate is expected to generate 2.15 million dollars in fees. This is a sharp drop compared to its 2024 performance (11.5 million) and 2023 (20.3 million). The entire bridge sector slowed at the start of the year, but Stargate’s decline has been more pronounced. Bridges remain an essential piece of the crypto ecosystem. This decline in generated fees is more likely a symptom of temporarily lower activity than of true structural decay in the sector.

This has been reflected in the STG token, which has fallen threefold since the start of the year. Priced at over 4 dollars shortly after its 2022 launch, it has mostly trended down and trades around 0.16 dollars at the time of writing.

Finally, note that a report published in late July 2025 valued Stargate’s treasury at 147.7 million dollars, including 52.3 million in STG tokens. The remaining 95.4 million consists mostly of USDT and USDC, plus a small portion in ETH and other tokens. This point is essential for understanding what follows.

Timeline of events

It all began on August 10 with a post by the LayerZero Foundation on the Stargate forum, where the foundation proposed acquiring Stargate for 110 million dollars. Their stated objective was to replace the Stargate DAO in order to accelerate the protocol’s development via an “aggressive roadmap” and better alignment around a single token.

Their 110 million dollar offer would buy all 660 million STG tokens currently in circulation (treasury holdings excluded) at a price of 0.1675 dollars, which is 2.3% above spot.

The buyout would take the form of converting STG into ZRO, LayerZero’s token, at a fixed rate of 0.08634 ZRO per STG. Starting August 10, the community had seven days before a vote.

Reactions came quickly. While some DAO members seemed interested and saw an opportunity to accelerate development, the vast majority strongly opposed the proposal.

The reasons for the criticism were:

- Lack of added value for STG holders

- Long-term removal of the revenue redistribution system to the DAO

- Significant dilution for STG holders who would swap a token with 68% of supply circulating and no team/VC unlocks for ZRO, which has just over 11% circulating yet already double the market cap

- A price seen as very low relative to Stargate’s real potential

“As a holder of both STG and ZRO, I support this acquisition as a positive step for the long-term health of both projects” - “I’m yet to see the direct benefits for STG holders / stakers” - “LayerZero will have acquired this for almost nothing.” - “STG holders will exchange their tokens for ZRO at a very low price and will have to hold ZRO directly without receiving stake income. The only losers here are STG holders. Therefore, LayerZero should either significantly increase its offer or this sale should not proceed”. - Members of the DAO.

Within 24 hours, the LayerZero Foundation added several clarifications:

- Foundation members and LayerZero Labs would not be allowed to vote

- During the first six months, staked veSTG holders would receive 50% of Stargate revenues

Even if some members appreciated this update, it remained very light compared to demands from many DAO members who argued these new terms were still not beneficial to them.

On August 12, LayerZero held a community call to answer DAO questions. Several details were added:

- During the first six months, 50% of revenues would go to previous staked veSTG holders and 50% would go to ZRO buybacks. After this period, 100% of Stargate revenues would fund ZRO buybacks

- ZRO used for the conversion would come from the LayerZero Foundation

- The roadmap planned to launch new products quickly (6 to 8 months) with a strong focus on monetization to maximize generated revenues

DAO responses were more mixed: still frustrated by what was seen as a low offer from LayerZero, but recognizing the contribution LayerZero had made to building Stargate. In that sense, they would be the most suitable party to restart Stargate’s growth, especially in the face of competing buyout proposals from rival bridges.

“The very existence of Stargate as it is today would not have been possible without LayerZero’s capital and technical support. In this context, it’s hard for anyone to deny that if Stargate is to be sold or acquired, LayerZero is the most suitable party to take it forward.” - Member of the DAO.

A few days later, on August 20, the Wormhole Foundation entered the fray with its own offer: 120 million dollars. While that may seem only slightly higher (9% above LayerZero’s), it was actually far more significant because it was the first to factor in Stargate’s treasury.

Since Stargate held 95.4 million dollars in assets, LayerZero’s 110 million dollar offer valued the protocol itself at 14.6 million dollars, or 6.8 times its annualized fees. By comparison, Wormhole’s offer valued the Stargate bridge at 24.6 million dollars and a ratio of 11.4, a 68% premium.

Following this proposal, the Wormhole Foundation requested that Stargate provide detailed information about DAO-held assets, liquidity, user numbers and distribution, accounting, finances, and other key data.

This counteroffer triggered a new wave of criticism among DAO members, who saw it as a way for Wormhole to extract sensitive information from one of its main competitors. In the days that followed, to show good faith, Wormhole deposited 120 million USDC into a public address.

It is important to know that when Wormhole made its offer on August 20, the governance vote to decide on LayerZero’s buyout had already been underway for three days. The Wormhole proposal then faced rejection because, even though it was more attractive than LayerZero’s, it still offered very little advantage to DAO members. At the same time, some called to stop the ongoing vote in order to consider potential buyers’ offers.

“There are now two official bids (LayerZero and Wormhole) and two formal intents to bid (Axelar and Across). Recommendations: Pause voting on the current proposal […]. Disclose all material information to qualified bidders signing an NDA, given LayerZero’s close association with Stargate.” - Member of the DAO.

At this point, the Axelar Foundation signaled interest, without proposing an explicit amount, showing willingness to participate in the bidding. This had little impact on discussions, and only a few hours later the vote closed in favor of the LayerZero buyout with 95% “Yes.”

More than 15,000 different addresses participated, 96.7% voting “Yes,” but representing only 8% of staked veSTG, which is just 1.1% of total circulating STG. Participation was low, but still twice as high as past proposals in the Stargate DAO. The ten largest addresses represented 81% of votes, all voting “Yes,” which was more than enough for the proposal to pass by a wide margin.

After this approval, LayerZero quickly posted on X, emphasizing its plan to make LayerZero a liquidity hub for swaps and stablecoins while riding the wave of asset tokenization. This marks the end of the Stargate DAO, which will soon be dissolved with STG converted into ZRO and the two entities merged.

“With the recent passing of the LayerZero Acquisition of Stargate (STG), the StargateDAO has been officially dissolved.” - StargateFoundation

Analysis

The Stargate buyout by LayerZero raises several concerns. First, the proposed offer looks meager. Even excluding the treasury from the calculation, LayerZero’s proposal values the protocol at 14.6 million dollars versus 12.6 million at the current market price, only a 15% premium.

It also offers no tangible advantages to STG holders apart from the promise of rapid, aggressive development. Otherwise, they lose all benefits tied to holding the token and do not receive compensation commensurate with the risks they took.

It also appears the process was rushed. A window of only seven days to discuss a buyout of this magnitude seems far too short. LayerZero’s knowledge of Stargate’s specifics gave it an unfair advantage to move quickly. LayerZero did not allow the DAO time to explore serious competing offers or negotiate more favorable terms.

The Wormhole offer, in particular, was much more attractive, with a 95% premium on protocol value alone (excluding the treasury) and a cash payment, but it came too late. In addition, the DAO clearly did not want a competitor to acquire the protocol. Faced with that threat, choosing LayerZero became a defensive move, even though it was less advantageous and not widely desired.

Finally, LayerZero’s communication suggested the goal was clearly to “bring the bridge back home”, as if Stargate already belonged to them. The vote, concentrated among a few large holders, allowed for a quick resolution despite relatively low participation and limited consensus on the forums.

The buyback mechanism to be implemented will directly benefit all ZRO holders, and therefore also former STG/veSTG holders, but they will be more diluted. This acquisition will consolidate revenues LayerZero already generates through its infrastructure (5.4 million dollars per year).

All of this reinforces the impression that the operation aimed to secure the protocol for LayerZero’s benefit by taking advantage of a market valuation that was already low. The historical community, meanwhile, is compelled to join a larger project with more resources to develop the protocol, but with upcoming unlocks that will multiply ZRO’s supply eightfold over the next twenty-four months.

Conclusion

In short, this buyout illustrates that the crypto market is maturing, with protocols now treated like real companies capable of structured acquisitions. It is a positive sign that strategic, planned transactions are possible.

However, this deal also raises questions about governance and buyout processes going forward. The speed of the vote, the concentration of decisions among a few large holders, and the lack of meaningful exploration of competing offers underscore the need to establish clear and protective procedures for these new kinds of structures. This would help prevent the interests of minority holders from being marginalized in aggressive, targeted transactions.