Cap Money: a layer for verifiable yield on stablecoins on MegaETH

November 18, 2025

In this post

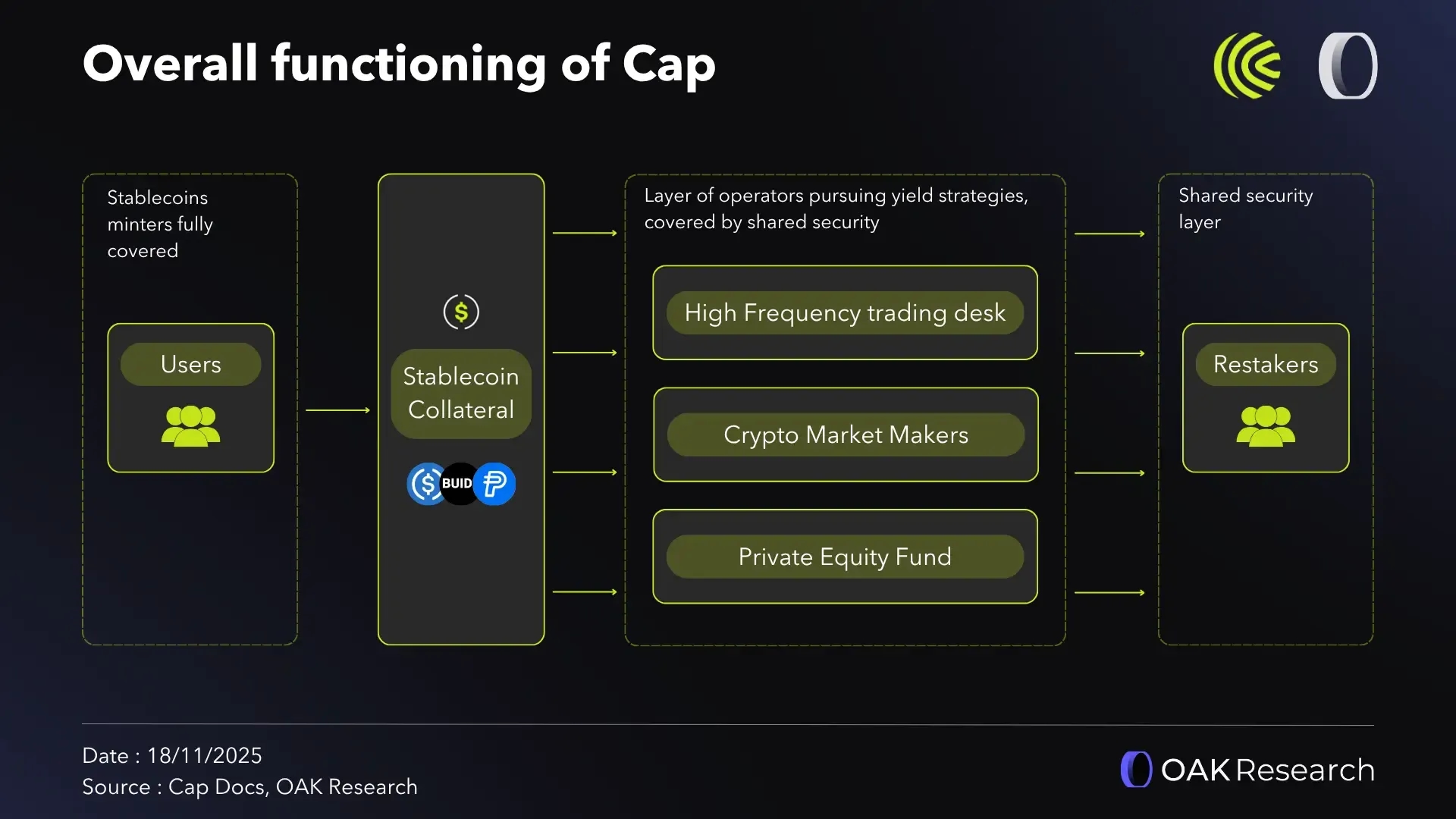

Cap is a protocol built on MegaETH offering cUSD, a synthetic dollar backed by a basket of stablecoins, and stcUSD, its staked version offering yield. Cap's value proposition is to separate yield from risk through an infrastructure based on operators (yield managers) and restorers (risk managers). In this second edition of Early Bird, discover Cap, how it works, its thesis, our farming strategy, and our opinion.

Introduction

The stablecoin sector is already one of the pillars of on-chain finance, but it is likely to become its main representative in the years ahead. With more than 200 billion dollars in combined market cap, it now concentrates most of the liquidity and remains one of the primary entry points between traditional finance and crypto.

This central role has not gone unnoticed by institutional players, who are actively looking for ways to gain exposure. However, this is not necessarily true for retail investors, who mainly see stablecoins as a way to secure profits and prefer to speculate on more volatile tokens.

For years, the stablecoin sector has been dominated by a duopoly: Tether and Circle. The main issue is that these entities remain black boxes, inaccessible to users who would like direct exposure to them or at least to capture part of the revenues generated by their reserves.

That dominance is now starting to erode. New protocols are trying to redefine the stablecoin model, both in terms of how they work and how they redirect value toward the ecosystems or blockchains that enable them.

In this context, a new emerging sector is forming around stablecoins and their associated yields. These protocols are laying the groundwork for future on-chain yield managers, which will become the main access point to DeFi for many investors. But to get there, the underlying infrastructure has to be built first.

Cap is one of the most interesting protocols within this trend, sitting at the crossroads between centralized stablecoins and their decentralized competitors, with the clear ambition to solve the fragmentation of stablecoins and the associated yield opportunities.

What is Cap?

Overview

Cap is an on-chain finance protocol that describes itself as “a credibly neutral and verifiable money layer”, designed to unify the existing stablecoin stack and address the centralization and lack of transparency in yield generation.

In practice, Cap aggregates several regulated stablecoins (such as USDC, PYUSD or BUIDL) into a single reserve to create a synthetic dollar: cUSD. This approach aims to solve the current fragmentation between different on-chain dollars while guaranteeing liquidity and interoperability between them.

At the same time, Cap makes this synthetic dollar productive through stcUSD, a yield-bearing version of cUSD. Yield is generated by a network of independent operators who borrow liquidity from the protocol to execute strategies, while being insured by capital delegations coming from restaking networks such as EigenLayer or Symbiotic.

Cap does not try to compete with Tether or Circle directly. Instead, it operates as an open aggregation layer that pools their tokens into a unified, auditable reserve. The protocol combines the opportunities of on-chain finance with the standards of traditional finance to create a system where yield is automated and verifiable, and where risk is carried not by end users, but by operators.

Currently live on Ethereum, Cap is one of the flagship projects in the MegaETH ecosystem. The protocol plans to deploy on the MegaETH mainnet once it launches, expected in early 2026.

cUSD

Cap’s first product is cUSD, a synthetic dollar fully collateralized by a basket of regulated stablecoins (USDC, PYUSD, BENJI and BUIDL, among others). Rather than creating yet another stablecoin, Cap offers a unit of account backed by existing assets and designed to address the fragmentation of the stablecoin market.

Concretely, cUSD is managed by a smart contract that acts as a Peg Stability Module (PSM), allowing users to mint, burn or swap cUSD against any reserve asset at its oracle price. When a redemption occurs, funds are returned as a proportional basket of underlying assets, which helps maintain the peg for all users.

Idle assets in the reserve are not left unused. They are deployed into protocols such as Aave or Morpho to generate a base yield while remaining available at all times for withdrawals. This way, cUSD aims to guarantee peg stability, permanent liquidity and decent capital efficiency.

In other words, Cap is not trying to reinvent the stablecoin, but to provide an interoperable and unified standard on top of existing stablecoins. Where it gets more interesting is with the next product.

stcUSD

Cap’s second product is stcUSD, a yield-bearing version of cUSD. By staking their cUSD, users receive stcUSD, which gives them automatic access to the yield generated by the protocol.

Instead of relying on a centralized decision-making process for yield generation, Cap uses a network of independent operators who borrow part of the reserve to deploy strategies.

Operators are not whitelisted by default. They must first secure capital delegations from restakers via Shared Security Networks (SSNs) such as EigenLayer or Symbiotic. Restakers are responsible for assessing operator risk and locking their assets as collateral in order to underwrite one or several of them.

If an operator defaults or the value of their delegated collateral falls too far, an automatic liquidation process is triggered: positions are closed, restakers’ funds are slashed and used to immediately cover any potential shortfall in the reserve.

stcUSD is therefore a stablecoin that offers competitive, transparent and partially decentralized yield (at least in the sense that decisions are not concentrated in a single entity). Most importantly, it provides an embedded insurance mechanism where risk is shared with operators and restakers.

How Cap works

Cap relies on an architecture designed to automate yield generation and delegate risk management across a set of well-defined actors. The protocol operates without active governance, with coordination driven purely by economic incentives.

Cap’s functioning revolves around four main categories of actors: cUSD and stcUSD holders, operators, restakers, and liquidators. Each plays a specific role in maintaining system stability and distributing yield.

cUSD holders provide the monetary base. They deposit stablecoins into the protocol and receive cUSD in return, which they can hold as a standard stablecoin or convert into stcUSD to earn yield generated by Cap.

Operators

Operators are at the core of yield generation in Cap. Their role is to borrow liquidity from the protocol (the reserve backing cUSD) and deploy it into on-chain yield strategies. This can involve market making, arbitrage, lending, or any other activity capable of generating yield.

They are typically institutional or professional entities (curators, market makers, asset managers, and so on). At the time of writing, Cap lists 18 operators for a total of 14 million dollars borrowed, out of roughly 278 million dollars in TVL. Among them are StakeStone, Concrete, Hyperithm, Pareto, Re7 Capital, Amber Group, Gauntlet, Flowdesk and GSR.

Before they can borrow, operators must be underwritten by one or several restakers who agree to delegate their assets as collateral. These delegations effectively act as an insurance pool for users: if the operator incurs a loss or fails to repay, restakers are slashed to cover the shortfall.

Operators have some negotiating power. They can agree with their restakers on a fixed rate (the “restaker rate”) or a variable revenue share. As long as they respect risk thresholds and collateralization requirements, they are free to adjust their strategy and borrowing terms.

Restakers

Restakers act as a sort of trust intermediary between the protocol, users and operators. To understand their role, it is helpful to define Shared Security Networks (SSNs), which are a core component of Cap’s design.

SSNs are central to restaking. The idea is straightforward: instead of building their own economic security infrastructure (usually via staking), new protocols can rely on a shared base of restaked assets.

Cap uses SSNs in a novel way by having restaked assets serve as guarantees for operators and, by extension, as protection for users. In other words, yield generation is separated from underlying risk. Operators are not vetted by the Cap team but by the market itself: restakers, through their delegations, decide who they trust and at what price.

In practice, Cap uses Symbiotic (and later EigenLayer) to enable restaking into vaults associated with operators. Restakers are responsible for doing due diligence on operators and understand they can be slashed if something goes wrong. In return, they receive a share of the yield generated by the strategies they underwrite.

Vaults allow risk to be isolated. Only restakers who deposited into the vault of a failing operator are affected by slashing, rather than all participants being impacted.

Cap’s model also allows restakers to sign off-chain Guarantor Agreements with operators, specifying loan terms and recourse conditions in case of default.

This point is critical: most Cap operators are regulated entities, which means the probability of an actual slashing event should mainly correlate with a genuine bankruptcy or severe failure.

Yield and liquidation mechanics

Cap effectively has a yield floor: the rate generated by USDC on Aave. As mentioned above, a large share of funds is deployed on Aave to ensure a minimum yield and instant liquidity for withdrawals.

When an operator identifies a yield opportunity above that floor and has already secured sufficient delegation, they borrow from the reserve, execute their strategy, then repay the principal plus interest.

Yield is then split between the different parties: one share goes to stcUSD holders, another pays restakers (the “restaker rate”), and the remaining surplus is captured by the operator. In case of a loss, a slashing event is triggered: the operator’s associated delegations are partially seized and sold off to restore the reserve.

Several audit reports have confirmed the robustness of this slashing and liquidation logic, including the most recent one by Certora (September 2025). The audit concluded that the protocol does not rely on any single critical centralized actor and that risk coverage is entirely verifiable on-chain.

In summary, Cap’s economy is built around a balance of incentives: users deposit stablecoins and earn yield, operators generate performance, restakers insure the system, and liquidators keep it stable. Each participant is rewarded for their contribution and penalized in case of failure.

The Frontier Program

The Frontier Program is Cap’s community campaign, launched to accompany the rollout of the protocol on Ethereum and prepare for its deployment on MegaETH. The goal is to reward the protocol’s most active users while testing its products and economic mechanisms in real conditions.

Rewards take the form of Caps, a points system distributed based on how users interact with the protocol. The program is structured into epochs, that is, successive periods during which users accumulate points based on their on-chain activity with Cap.

The Frontier Program started on August 18, 2025, with Cap’s public launch on Ethereum mainnet. During this initial phase, staking stcUSD was not yet enabled, and the goal was to bootstrap the protocol by attracting liquidity and building an initial cUSD reserve.

Epoch 2 began on September 1, 2025, and focused on using cUSD and stcUSD across partner protocols. After the bootstrapping phase, this stage aimed to promote real usage of the stablecoin in DeFi via integrations with Euler and Pendle.

Epoch 3, announced on October 6, 2025 and launched on October 13, is the final phase of the Frontier Program. It is expected to run until the end of the campaign, around mid-January, or end earlier if certain internal metrics are hit.

Caps rewards are distributed as follows:

- x1 for stcUSD holders

- x5 for YT-stcUSD holders or LPs in the stcUSD pool

- x10 for cUSD holders who forgo yield

- x20 for YT-cUSD holders or LPs in the cUSD pool

Loyal users who have participated since the early stages receive a longevity bonus that increases the effective value of their final Caps balance. Users depositing liquidity on Euler or Morpho markets continue to earn rewards at a rate of x1 on their Caps.

Epoch 3 also introduced a new category of separate points, called COGs, for active delegators on Symbiotic and, in the future, on EigenLayer. These points are meant to measure direct contributions to protocol security and are tracked via a dedicated dashboard.

Opportunities and risks

Cap is positioned within a fairly straightforward opportunity window. The MegaETH mainnet launch is expected in early 2026, and the team has announced that 2.5 percent of the supply will be allocated to early mainnet users. In other words, getting early exposure to Cap, one of the most interesting native protocols, is a simple and direct way to maximize one’s chances of gaining exposure to MegaETH.

Timing also works in favor of active users. Cap has already structured its launch phase through the Frontier Program, which should end roughly five months after it began, around mid-January, in line with the expected launch of MegaETH. This suggests that the Cap token airdrop will likely take place relatively soon after that. For those looking for short- to medium-term opportunities, the “Cap airdrop + MegaETH exposure” combo is compelling.

From a fundamental standpoint, Cap offers something interesting and innovative in a growing sector: simplifying yield on stablecoins for users. It also addresses a major criticism in DeFi, especially since the rise of on-chain yield managers: the opacity of yields and the tendency to push most of the risk onto end users.

Today, too many protocols advertise high APYs, managed by centralized curators whose strategies are not clearly disclosed. When a market shock hits, like on October 10, it is the end users who eat the losses. Cap’s model shifts that risk to operators and restakers, while stcUSD holders are theoretically kept whole.

That does not mean risk disappears. There is standard smart contract risk, as with any on-chain protocol. There is counterparty risk on SSNs: Cap relies on shared security marketplaces such as Symbiotic and, in the future, EigenLayer. A failure at those layers or mismanagement of delegated collateral could trigger faster-than-expected liquidations, even if current audits are positive.

The cUSD collateral basket introduces depeg risk due to diversification, even though the protocol mitigates this via the PSM and proportional basket redemptions. Idle assets temporarily deployed on Aave or Morpho also expose Cap to those protocols’ risk, even if it is theoretically limited.

Finally, the most important point relates to the launch of the Cap token. In recent months, the market has systematically rejected new protocol tokens, as it is saturated and investors pay little attention to altcoins, aside from a few exceptions.

If the MegaETH launch goes well and the network attracts strong traction, Cap could benefit from that tailwind, which might help its token hold a reasonable valuation. If not, there is a significant chance the market will reject this TGE in the same way it has rejected many others.

Takeaways, conclusion and farming strategy

In this Early Birds series, we mainly highlight opportunities to gain exposure to protocols offering interesting airdrop potential. Among the projects we have covered and will cover in the future, Cap stands out by being embedded in a promising ecosystem, with a strong narrative on top.

That said, given the current market context, our base case at TGE would be to sell a large part of the airdrop to cover farming costs and lock in potential profits. Over the coming weeks, we will refine how much, if any, of the airdrop we intend to hold, and we will share those decisions in our Alpha Feed.

Our detailed farming strategy is also shared exclusively with Premium subscribers in our Alpha Feed. There, we explain exactly how we structure our capital to target a position within the top 5 percent of the Cap leaderboard.