Backpack: A deep dive into a crypto-native financial institution

November 11, 2025

Sponsored Content

This content was written as part of a commercial collaboration. Although the OAK Research team conducted a preliminary assessment of the project presented, we disclaim any liability for losses or damages resulting from decisions based on this article. Cryptocurrencies involve high risks, and this content is provided for informational purposes only and does not constitute investment advice.

In this post

If anything has found product-market fit in crypto, it’s users’ demand for a complete suite of products and features. In this report, we show how Backpack meets that need by positioning itself as the industry’s “Swiss Army knife,” integrating a self-custodial multi-chain wallet, a regulated exchange, and applications in a single unified platform.

Rethinking a broken system

In decentralized finance (DeFi), people say “code is law,” but security decides destiny. In the race to build on-chain finance, the ecosystem has left behind all sorts of risks tied to smart contracts, architectures, or self-custody models, which makes crypto inherently risky and unreliable, with multiple pain points.

For example, you can lose your phone or hardware wallet and permanently lose all your assets. Another issue is trust assumptions and execution flaws, including server-side rugs and vulnerabilities, where off-chain components can compromise on-chain security, for instance through blind signing of transactions.

There isn’t an out-of-the-box fix. Take EIP-4337 (Account Abstraction), which lets smart contracts function as user accounts, moving beyond the traditional EOA model and CeFi KYC solutions. While it addresses part of the problem, it doesn’t provide a complete solution, with DeFi accepting the status quo and CeFi requiring blind trust in a centralized counterparty.

Backpack aims to offer an alternative. Rather than optimizing around a broken system, the team chose to rethink the process from first principles. By leveraging the state-of-integrity concept enabled by Zero-Knowledge (ZK) proofs and daily proof-of-reserves with ZK verification, Backpack has engineered its exchange to be both secure and transparent.

One of Backpack’s key features is 2-of-3 multisig support (the only Solana wallet to offer it) along with compatibility with Ledger, Trezor, and Keystone hardware wallets, adding an extra layer of security. It’s a blend of the best of both worlds: CeFi and DeFi.

Background and history of Backpack

The genesis of Backpack

Founded in 2022 by Armani Ferrante, then a Solana developer, and former FTX executive Tristan Yver, Backpack builds a broad product suite: the Backpack Wallet, Backpack Exchange, and the Mad Lads NFT collection.

Backpack’s story began with Ferrante’s open-source work for Solana in September 2020. For over a year, he focused on developing tools and applications, including wallet infrastructure, DeFi protocols, and developer tooling.

As Solana took off, new developers faced a steep technical barrier: writing programs required time to learn Rust, and there were no standard frameworks like Ethereum’s Hardhat or Truffle.

Through the crypto infrastructure company Coral, Ferrante created Anchor. It’s an open-source framework designed to simplify building Solana programs (the equivalent of smart contracts). Developed in late 2020, Anchor quickly became the standard tool for Solana developers, laying the groundwork for what followed.

In September 2022, Coral raised 20 million dollars in a strategic round co-led by FTX Ventures and Jump Crypto to develop two things: Backpack, and a token standard on Solana called executable NFTs (xNFTs).

The birth of Backpack and xNFTs

Backpack Wallet launched as an interactive wallet that gives users access to all their assets and decentralized apps in one place via xNFTs. Coral built Backpack and the React-xNFT developer framework with the idea of unifying a wallet, an execution environment, and a marketplace for various xNFTs.

It grew from the Fat Wallet thesis: a smart wallet that reclaims much of the value that used to accrue to protocols or individual dApps. The key tenets of Backpack Wallet are a focus on security, multi-chain account abstraction, and user experience.

Backpack’s value proposition is a permissionless super app, similar to an operating system that provides a base where developers can build consumer applications on a shared app store. xNFTs are analogous to mini-apps, with Backpack as the OS. It embeds executable code in a non-fungible token (NFT), effectively functioning as a native dApp within the Backpack ecosystem.

This means any Backpack wallet user can access all assets and dApps natively in one place. The xNFT standard also lets any Solana dApp create and execute xNFTs natively inside Backpack Wallet. And since NFTs aren’t the only crypto assets, Backpack serves as a universal interface, from staking and trading to marketplaces and price trackers.

Three years ago, Backpack’s pitch could have been an “iPhone launch moment” for the Solana ecosystem: xNFTs as apps, an xNFT marketplace as the App Store, and CoralOS as the execution environment (iOS). But the story went differently: two months later, in November 2022, FTX collapsed and Coral lost 14.5 million dollars, or 88% of the company’s operating funds.

The success of the Mad Lads NFTs

The post-FTX comeback

Coral lost FTX’s investment when the exchange imploded, as well as half of the funds from Jump. Even without that capital, the platform leaned into the void left by FTX’s fall, emphasizing security features, regulatory compliance, and a rewards system to bounce back.

Composed of a highly experienced team, Coral successfully launched the xNFT protocol on Solana along with its wallet, Backpack. That resilience helped it peak during a critical moment for crypto. The team’s relentless execution cemented its reputation as a reliable, forward-leaning platform, encouraging both seasoned and new users to explore its products.

In April 2023, during the bear market, Backpack launched the Mad Lads NFT collection. It’s the flagship NFT set in the ecosystem, with 9,000 “Lads” and 1,000 “Lassies.”

The idea of empowering users rather than centralizing power is core to Mad Lads. For some, Mad Lads disrupted the broader NFT meta. At the time, many collections lacked long-term vision and real utility despite big promises. Instead, Backpack leaned on storytelling, distribution, and the soulbound meta, pioneering direct-to-wallet airdrops.

“It will be a rug”

The most important part of the Mad Lads story is the mint. First, the team literally announced the mint would be a “rug,” and buyers did mint a “rug” NFT (a literal rolled-up rug). The whitelist phase had no issues (rare at the time), but the public mint was delayed 24 hours due to a bot attack trying to snipe the launch.

The team shipped a clever fix: two mint contracts. Human users minted the real NFTs, while bots were redirected to a “minting update” that funneled them into a honeypot. After the mint, the bot addresses were refunded from the 250,000 dollars in SOL captured by the contract.

Finally, after the public mint closed, all holders entered a game where they had to defeat a character called the “Mad King” to receive their Lad. It wasn’t minting but a summoning, showcasing Backpack’s ambition at the time and, more importantly, what xNFTs could do.

In the first week, Mad Lads topped NFT charts across chains, helping draw attention to Solana. Mad Lads soon became Solana’s number one NFT by market cap and trading volume.

A tight link to Backpack

The Mad Lads NFTs were built to showcase what’s possible with Backpack Wallet, such as token-gated community chats, soulbound inventory, loyalty rewards, collection locking, and embedded mint and claim.

Each NFT minted at 6.9 SOL back then. Today, the Mad Lads collection has a market cap of 84.9 million dollars and a floor of 36.9 SOL (8,524 dollars).

The point of Mad Lads has always been to help build Backpack. Anyone who got on the whitelist, minted, staked, or did anything with a Mad Lads NFT quickly realized Backpack was always in the background.

The relationship between Mad Lads and Backpack is deeply intertwined, creating an ecosystem where holders get exclusive access to certain Backpack features. For example, stakers enjoyed VIP tier-1 access on the Backpack exchange.

Mad Lads Strategy

A new platform, Bandsdotfun, introduced a financial product called “Onchain ETFs” to revive activity in Solana’s NFT markets. Inspired by Ethereum’s PunkStrategy and PudgyStrategy, these tokenized baskets target collections like Mad Lads and use fee revenue to push them higher.

LadsStrategy has already accumulated 53 NFTs valued at over 2,170.5 SOL. The protocol charges a 2.5% fee on buys and sells, where:

- 80% goes to a wallet that buys floor Mad Lads

- 10% goes to the Mad Lads team

- 10% goes to bandsdotfun

When there is enough SOL in the wallet, it buys floor Mad Lads on Tensor, then relists them at 1.2x, creating a reinforcing flywheel.

What is Backpack Exchange?

Overview of Backpack Exchange

Crypto today is split between almost-traditional financial platforms that are compliant but censorable, and decentralized protocols that are open to everyone but lack guardrails. Exchanges sit in the middle and often compromise between transparency, censorship resistance, and compliance.

Backpack’s vision is high performance without compromising transparency or censorship resistance. The exchange differentiates itself as a fully regulated, easy-to-use global trading platform while offering a secure interface and native proof-of-reserves to guarantee on-chain transparency.

Backpack ran a private beta in November 2023, then launched publicly in Q1 2024. The founding vision was to offer the best platform for users to access advanced trading tools that were typically reserved for institutional participants elsewhere.

Backpack is led by CEO and founder Armani Ferrante. Other team members include Thomas Linton (CTO), Oliver Sleaver (CFO), Can Sun (CCO), and Laurence King (Head of Audit). In February 2024, Backpack Exchange raised 17 million dollars in a Series A.

The round was led by Placeholder VC with participation from Hashed, Robot Ventures, Amber Group, Wintermute, and Selini. At the time of writing, Backpack Exchange has facilitated over 100 billion dollars in total trading volume. It is available in more than 150 countries and has completed more than 575 million transactions.

Architecture and technology

To support a wide range of traders and deliver robust real-time risk management, Backpack uses its own routing engine, a mechanism that automatically aggregates all user assets into a single cross-margin environment while enabling auto-lending.

- Auto-lending architecture

When enabled, Backpack’s lending architecture automatically adds all deposited assets to a dedicated pool, earning yield by default. User funds remain fully margin-eligible at all times, ready to support trading activity while generating passive income, without shuffling assets between “earn” and trading accounts.

Unrealized position PnL is treated as part of total collateral and continues to accrue yield until the position is closed.

In addition, when users lend USD through eligible assets on the platform, they earn the base lending rate plus extra monthly yield distributions. This incremental APY comes from exposure to U.S. Treasury yields via a diversified, curated basket of stablecoins.

SOL holders benefit too, with native Solana staking yields integrated into the lending program. Backpack stakes its proprietary SOL reserves and redistributes the full staking yield to all SOL lenders.

- Collateralization of loaned assets and capital efficiency

All assets lent through the platform remain fully margin-eligible, allowing users to use deposited funds as collateral for new trading positions. This improves overall capital efficiency and supports both liquidity and systemic stability.

Backpack’s yield architecture is natively integrated with the core risk engine, ensuring users retain full collateral value while simultaneously earning interest.

Backpack’s risk engine, cross-margin, and auto-lending features are designed to democratize high capital efficiency, benefits typically reserved for institutional or VIP tiers on other exchanges. Backpack lets traders of all sizes access that yield potential in a unified framework.

- Settlement flexibility and competitive fees

Backpack’s settlement engine introduces a dynamic realization mechanism that lets users partially realize PnL on a rolling basis. This is especially useful for hedging, high-frequency arbitrage, and complex multi-leg strategies.

Backpack’s choice to stay competitive with the lowest-cost exchanges is underpinned by an architecture described as “Interest-Bearing Perpetuals.” A borrow-lend market and perpetuals trading model allows user collateral to generate yield while simultaneously supporting margin and trading, keeping capital productive at all times.

Products

- Trading

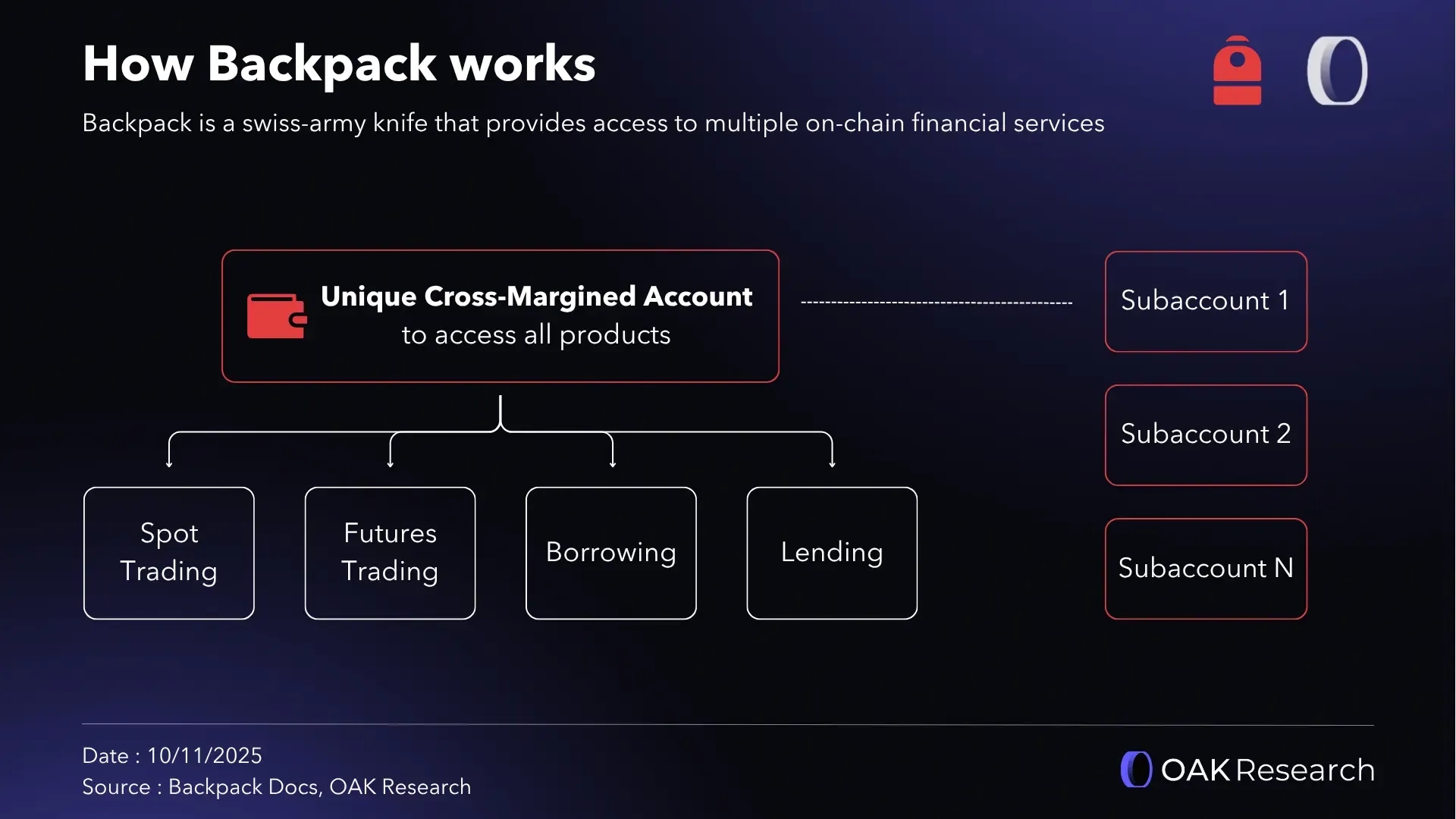

To enable a multi-currency cross-margin model, Backpack provides a single wallet that can be used to trade all products (spot, futures, spot margin, lending and borrowing).

Unlike conventional exchanges that require separate balances for spot, margin, and earn, this design also lets users isolate risk by creating a subaccount.

Each subaccount functions as an independent trading entity, fully segregated, ensuring a liquidation or loss in one does not affect the others.

Collateral on Backpack is denominated in USD and adjusted by asset-specific risk weights (collateral weights) that determine collateral value. They are calculated as:

Collateral Value = Token Quantity × Mark Price × Weight

This approach accounts for asset volatility and liquidity, dynamically adjusting effective collateral contribution. By contrast, Equity, or margin balance, represents the risk-adjusted total account value available to support open positions. It is calculated as:

Net Equity = Total Account Collateral + Unrealized PnL + Unsettled Balances − Total Borrow Liabilities. Available Equity = Net Equity − Locked Equity

This design integrates unrealized profits into usable margin, reinforcing the platform’s emphasis on capital efficiency.

On one hand, spot margin unlocks two capabilities of Backpack’s smart routing engine: traders can automatically borrow assets to complete a spot trade beyond their wallet balance, and borrowers remain continuously over-collateralized, with the risk engine triggering liquidation when needed to preserve solvency.

On the other hand, Backpack’s perpetual futures are engineered to maximize capital efficiency, with interest rates across markets determined dynamically by the utilization curve of the underlying borrow-lend pool.

Currently, all perpetual markets are quoted and settled in USDC, ensuring consistent pricing. Lent assets can also be used as collateral to open and maintain futures positions.

- Lending and borrowing

Backpack’s lending and borrowing system lets users earn yield without bridging assets. This multi-chain money market is a core component of Backpack’s margin system, enabling trading with the highest level of capital efficiency.

Backpack offers two lending modes: manual and automatic. With manual lending, lenders earn yield by supplying liquidity to the lending pool. With auto-lend, users automatically earn yield by depositing or buying a lendable asset.

- Affiliate program

To foster engagement and reward community participation, Backpack runs an affiliate program. Approved users who join, complete their application, and connect their contact information are eligible for a fee rebate on top of the standard 10%, resulting in higher direct commissions.

Partners refers to users who bring significant trading activity to Backpack Exchange. Eligibility criteria for this role are (on Backpack):

- At least 20 million dollars in monthly referral volume on Backpack

- No fewer than 15 active referred users per month on Backpack

- 5 new referred users per month on Backpack

Or (off-platform):

- More than 5,000 Twitter (X) followers

- Or an equivalent referral volume on other exchanges

Proof of Reserves

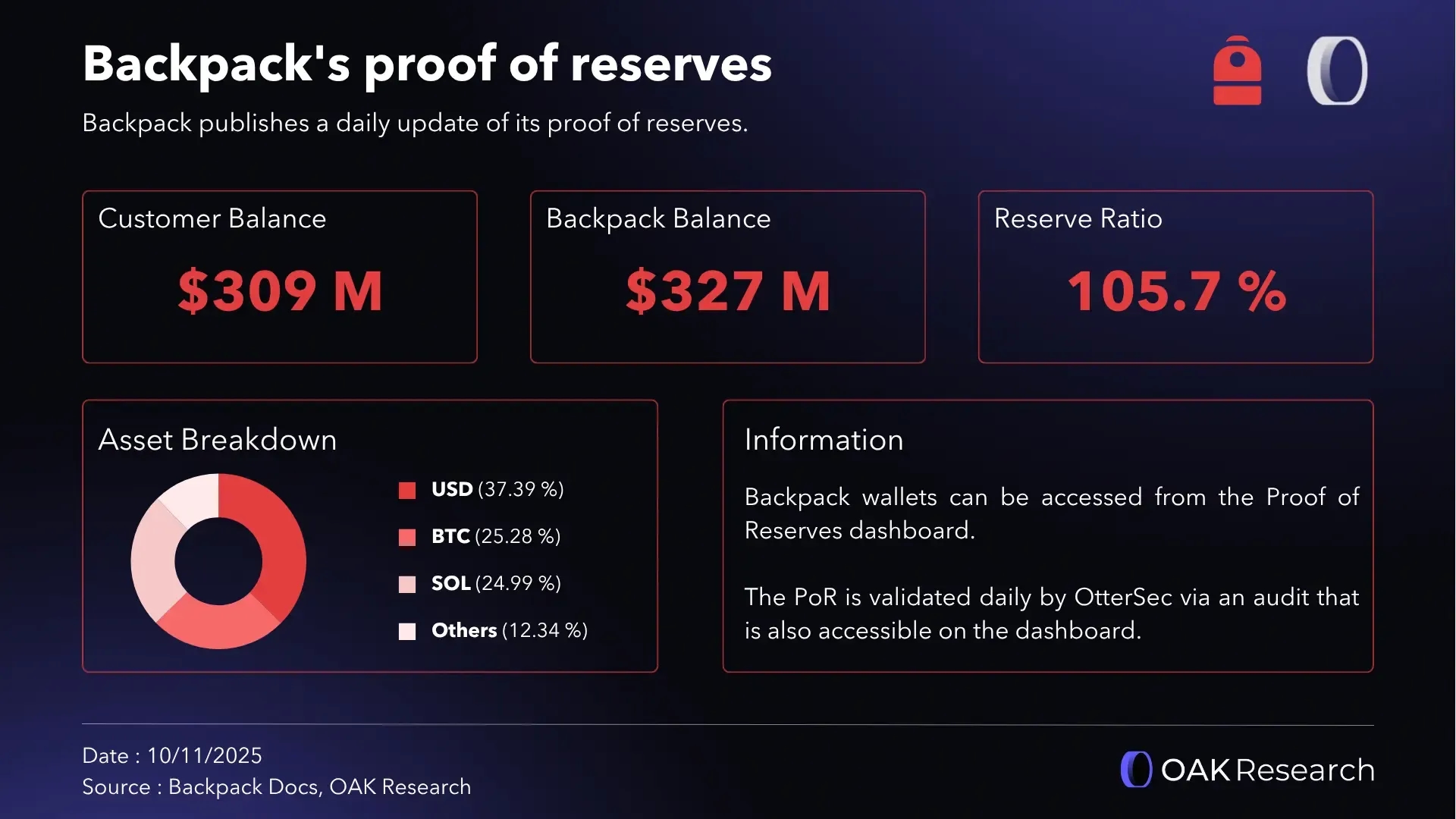

Since August 18, 2025, Backpack has published its proof of reserves daily. Backpack has never avoided discussing its connection to FTX, and its long-term vision is to position itself as a centralized exchange that rivals other CEXs in integrity.

Backpack introduced a verifiable exchange model by providing transparent snapshots, offering proof of reserves while preserving the privacy of assets held in individual wallets thanks to ZK cryptography.

Leveraging the FTX experience, Backpack is well positioned to unlock liquidity for users who care about a crypto-native version of finance. These efforts aim to position Backpack as an “on-chain CEX,” offering a secure trading experience to both individual users and infrastructure partners.

Usage metrics

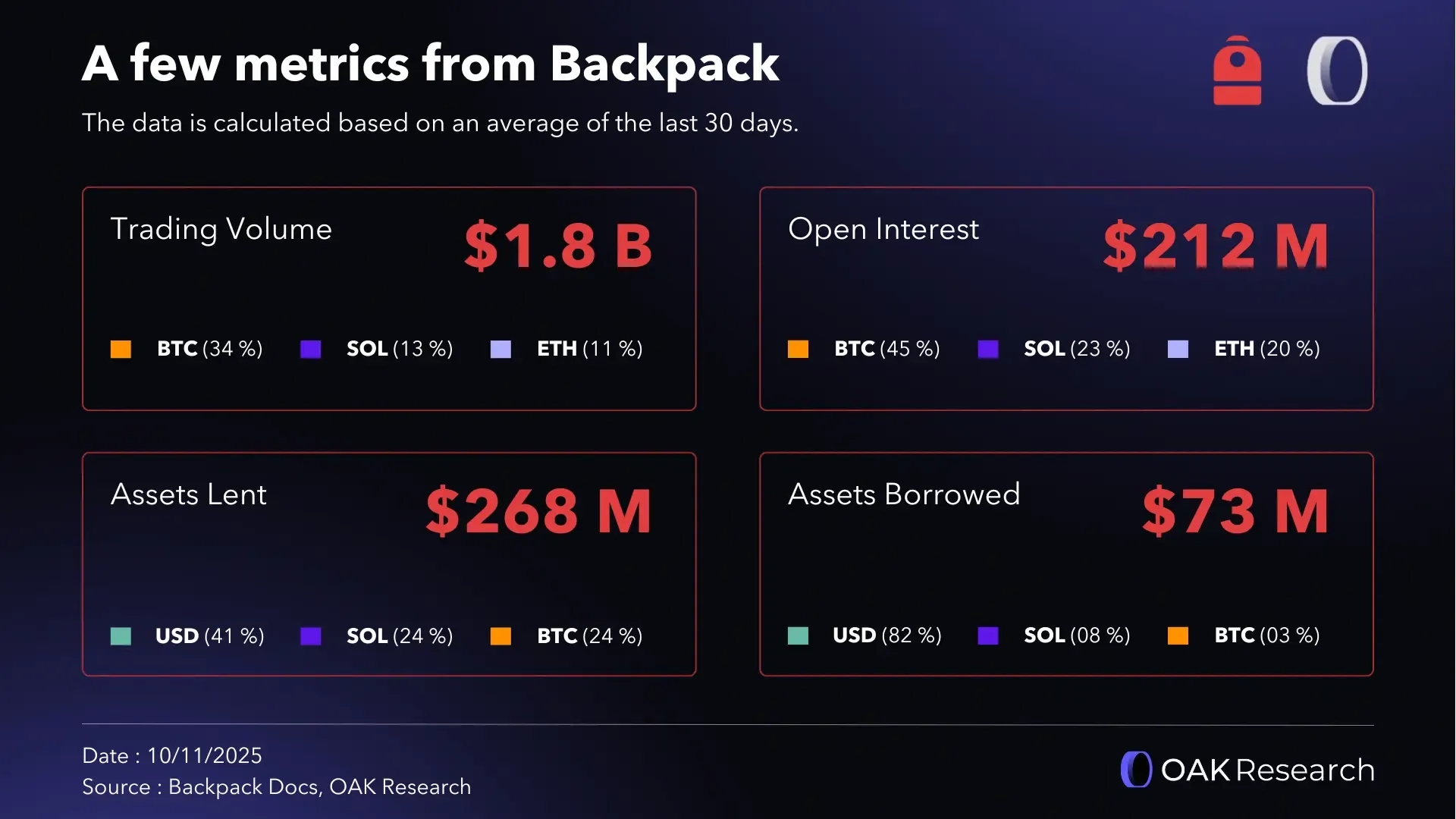

Despite building mainly during the 2023 bear market and competing with Solana DEX giants like Jupiter, Backpack has seen consistent trading volumes. Since launch, Backpack has facilitated 219.14 billion dollars in volume and currently has 561.42 million dollars in open interest (OI).

BTC-PERP (47.7%), SOL-PERP (21.1%) and ETH-PERP (15.6%) account for the majority of OI on Backpack.

The utilization ratio of Backpack’s lending product is 28.46%, with a total supply of $258.8 million. Furthermore, the majority of Backpack’s reserves is in USD-denominated stablecoins (37.45%), BTC (25.53%) and SOL (25.36%).

Backpack has maintained healthy trading activity. In total, 705 million trades have been executed across all markets since the platform went live.

Strategic vision

A “Swiss Army knife” vision

Since day one, Backpack has aimed to be more than a wallet or a trading venue. As trust problems persist in crypto, Backpack’s long-term vision is to reimagine system design by building a user-friendly, trust-minimized platform that can truly compete with traditional finance.

Backpack is well positioned to become a go-to platform for self-custody trading. It integrated Titan, a meta-DEX aggregator that offers optimal pricing on Solana swaps for native token transfers, and uses Wormhole for bridging.

Backpack’s main growth vector is blending wallet, exchange, and DeFi functionality while delivering a smoother user experience. Backpack Wallet has become the tool of choice for users who want to keep self custody while navigating DeFi, thanks to integrations with hardware wallets like Ledger, Trezor, and KeystoneWallet.

In short, Backpack’s roadmap is oriented around the “Swiss Army knife” vision that delivers advanced trading and deep DeFi integration.

Acquisition of FTX EU

Among Backpack’s major milestones is the 2024 acquisition of FTX EU and its EU MiFID II license. By acquiring the European arm of the defunct exchange, Backpack gained access to 110,000 former FTX EU users.

The key benefit is positioning the platform as one of the first fully regulated venues in Europe to offer crypto derivatives, starting with perpetual futures.

This move comes as the EU’s MiCA framework takes effect, setting standards and guidelines for virtual asset service providers intended, per the text, to protect consumers.

It marked a significant step for Backpack as it brings compliant, regulated crypto trading to the European market following the exit of many international exchanges from the EU.

The Backpack airdrop

In line with the acquisition strategy seeded by the Mad Lads NFTs, Backpack also kicked off a points campaign ahead of a future airdrop. A first snapshot took place on March 20, 2025 to reward historical users from 2023, prior to Season 1, which ran from March 21 to May 29, 2025.

Season 2 started on July 3, 2025, with a 10 million point bonus for users who stayed active between seasons. It ended on September 10, 2025, the day before Season 3 launched on September 11, 2025, with no official duration yet.

Points are distributed every Friday at 2:00 UTC, with a snapshot every Thursday at 0:00 UTC. Ranks are also in place: bronze, silver, gold, platinum, diamond, and challenger. Note that ranks reset each season. The preseason snapshot shows 475,000 users, in addition to Mad Lads holders.

How to earn points is straightforward:

- Go to the official site and create an account for your jurisdiction (or log in if you already have one).

- Complete KYC and set up 2FA.

- Deposit funds and use your Backpack wallet on Solana, Ethereum, or another network.

- Trade spot or futures, generating as much volume as possible without taking excessive risk to maximize your points.

Roadmap

Backpack’s roadmap is built around two main pillars. It is not a decentralized exchange, but a regulated one, with the ambition of becoming the largest crypto-native financial institution.

The first phase focuses on strengthening Backpack’s crypto foundation by improving its technical infrastructure and expanding its available features. This includes opening up to new validators, integrating an automated liquidity provisioning system, and adding an RFQ (Request for Quote) mechanism to asset pricing.

Among the major upcoming features, Backpack plans to introduce the ability to connect trading bots and create vaults. It also intends to launch a pre-market platform and develop a tool that allows users to easily convert their collateral without having to close their positions.

The second phase represents the most critical step: expansion into traditional finance. This transition marks the evolution from a crypto-focused exchange to a comprehensive financial ecosystem. A key objective will be expanding into new regions while obtaining the corresponding regulatory licenses.

Planned features include the introduction of fiat and foreign exchange (FX) services, access to stock markets, the implementation of banking services, and the launch of a payment card linked to user accounts.

Finally, these milestones will allow Backpack to open its doors to a new class of participants: institutional investors. The goal is to become the financial institution of reference for DATs (Digital Asset Treasuries) and to support future IEOs and IPOs.

Conclusion

Backpack has established itself as a Swiss Army knife in the ecosystem, offering a regulated trading and exchange platform together with a self-custodial multi-chain wallet and xNFT-powered app integrations.

From its post-FTX launch to today, through the viral success of Mad Lads and a well-executed growth strategy, Backpack keeps proving it puts the user at the center without compromising on security, positioning itself between TradFi and DeFi.

Looking ahead, Backpack will need to keep leaning into regulatory compliance and expansion, such as the FTX EU acquisition, to sustain growth across global markets.